We, Personal loan bangalore experts on analyzing factors and helps individuals to avail personal loans from various top private banks, here we listed the important aspects for availing Axis bank personal loan.

Axis Bank (formerly known as UTI bank), the third largest private-sector banks in India with around 2,959 branches and 12,743 ATM’s across the nation along with 9 international offices and employs over 50,000 people. With its quality service, Axis bank awarded as the “Best Performing Private Bank” in the Financial Advisor Awards 2015-2016 conducted by ICRA limited.

We, Personal loan bangalore here listed the eligibility factors for availing personal loan in Axis bank, along with various rules, which are considered as the Axis bank personal loan eligibility factors.

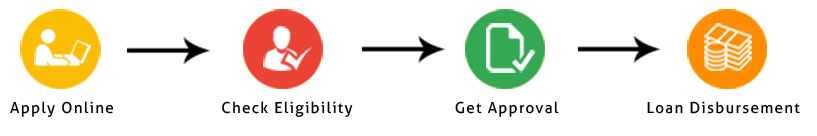

In order to avail Axis bank personal loan in Bangalore, we Personalloan-bangalore here listed steps would be helpful for individuals to apply for personal loan in Axis bank. These steps are much easier to do when compared with the procedure to avail loan from other banks.

| Service type | Interest rate |

|---|---|

| Rack Interest rates | 13.50% to 24% |

| Loan Processing charges | 1.50% to 2.00% + Service Tax as applicable |

| Pre payment Charges | Nil |

| Cheque bounce charges | Rs. 500 per cheque bounce + Service Tax as applicable |

| Cheque / Instrument Swap charges | Rs. 500 per instance+ Service Tax as applicable |

| Default Interest rate | 24% per annum i.e. 2% per month on overdue of installment |