Apply Canara Bank Personal Loan at lowest Rate of interest

About Canara Bank

Canara Bank is one of the oldest Banks in India having its headquarters in Bangalore, Karnataka. Being a leading public sector Bank, Canara Bank was established in the year 1906 by Shri Ammembal Subba Rao Pai in the coastal city of Mangalore, Karnataka. Canara Bank boasts of having more than 5727 branches, 9132 ATMs across the country. Canara Bank offers personal loans to their customers to provide much –needed funds during a financial crisis. Personal loan by Canara Bank offered to their customers comes with attractive interest rates, low processing charges, and easy payment options.

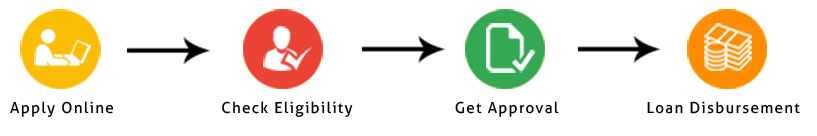

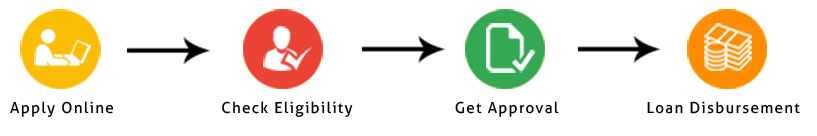

Canara Bank provides a range of personal loan products for different needs like marriage, home renovations, medical emergencies, foreign vacations, business developments etc. A personal loan in Canara Bank can get approved in maximum 2-3 days provided all the required documents are met by the applicant. Now, getting a Personal loan in Canara Bank is made very simple as the application process is hassle free to ensure quick approval of the personal loan. Getting a Canara Bank personal loan in Bangalore is very fast as customers can apply online with minimum documentation process, quick loan sanctions, monthly EMI calculators and much more to choose from.

Features of Canara Bank Personal Loans

Canara Bank offers different types of personal loans for customers to meet their personal financial needs. The personal loan offered by Canara Bank to each applicant depends on their documentation, requirement, repayment history, and CIBIL score. Canara Bank personal loan comes with the following attractive features.

- Canara Bank personal loans are long tenure loans where you can get up to a maximum of 5 years

- Canara Bank offers easy and convenient loan repayment options based on your convenience.

- Canara Bank Personal Loan offers attractive interest rates, smaller EMIs and easier for the customer to repay the personal loan amount.

- Canara Bank offers personal loans with easy documentation process keeping 100% transparency, lowest processing fee, and easy repayment options.

- Canara Bank ensures quick personal loan approval within 10 seconds for the first time loan seekers.

- Canara Bank offers multiple personal loan options depending on customer requirements and loan eligibility

- Customers can apply for a Canara Bank Personal loan online including online tracking of your loan application status.

- Canara Bank provides 24/7 customer support with dedicated customer care services to get your queries and doubts resolved online.

How to apply Canara bank personal loan online in Bangalore