HDFC Bank Frequently Asked Questions(FAQ)

What are the charges applicable for HDFC Bank personal loan in Bangalore?

Usually, the other banks apply a fee of 05%-2.5% as processing charges for clearing personal loan application. However, HDFC processes personal loan applications without taking any processing charges.

What are the eligibility criteria for HDFC Bank personal loan in Banglaore?

The eligibility criteria for personal loan are not very stringent. You need to have a source of income either from employment or from property so that the repayment of the loan is possible and you need to be below 60 years of age while applying for the loan. Also, these rules differ for salaried and self-employed.

How to choose the best personal loan in Bangalore?

Choosing the best personal loan is not easy. You need to invest time and effort to go through the various options. While there is no sacrosanct set of rules that you can refer to when choosing personal loan, one simple trick is to compare the HDFC personal loan interest rate with other banks. You can also compare the processing fees and other charges. Needless to say, applicants will realize that HDFC offers them the best possible deal.

What are the documents required for HDFC Bank personal loan in Bangalore?

Ideally, the bank’s representative will walk you through the entire process and also help you put the documents together before your file is submitted. However, here are some of the documents that you will need to be ready with when applying for personal loan.

- Identity proof

- Current / permanent residence address proof

- Salary slip for 3 months

- 3 -6 months Bank Statements

- Appointment letter and proof of work experience

- Photograph and PAN card photocopy

- Education proof

- Employment proof

- IT returns

How to check personal loan application status in hdfc bank?

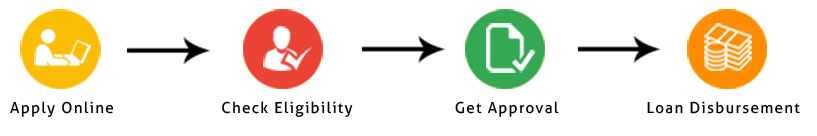

You can easily check the HDFC bank personal loan status online. You can easily get all the latest updates of the HDFC bank online. You can go through the HDFC bank customer reviews online to know more about the smart services and offers in HDFC bank. HDFC bank is a very friendly bank that offers exciting facilities to the loan borrowers.

Click here to view the status of your HDFC bank Personal Loan application.